Rental Property Investment – How To Earn Four Rental Incomes From One Property

In today’s hot real estate market, you may be looking for a way to increase the profit and potential of your block of land by investing in rental properties. Many property investors would be remised to let the opportunity for investing in investment properties and guaranteed profit pass by, and we are here to help.

Many of Australia’s larger cities are experiencing rapid growth and housing shortages, with house prices in Sydney rising to an average of $100,000 more since the properties were sold within the 2019-2020 financial year. First homeowners, investors, and buyers are left to battle it out at real estate auction, leaving pockets empty and the value of a stable home higher than ever. Within the first half of 2021 Sydney house prices, including units and apartments, rose by 6.7% – the highest rise since 2015. The increase in tenants ready to buy has impacted renters, with rentals increasing in price and lowering in availability.

As the real estate market meets demand, the demand grows, and the opportunity presents itself for homeowners, investors, and property managers to offer rentals, for profit, to the growing population of tenants who are desperate for long-term housing. If you’re one of the lucky real estate investors who has a block of land ready to develop and you’re looking for a way to provide functional, private and affordable housing to gain as much profit as possible, we have the solution for you.

Costs and Expenses of Property Investment

When you decide to invest in real estate rental properties, it’s crucial to think about all the different costs and expenses that you’ll encounter as investors. Firstly, there’s the purchase price of the property itself. This is the amount of money you’ll need to pay in order to become the owner of the rental property. It’s important for the buyer to keep in mind that rental income and rental yield can vary depending on the location and condition of the real estate property.

Repairs and Renovations

Next, you should also consider any necessary repairs or renovations that may be needed. Sometimes, a rental property may require some fixing up before it’s ready to be rented out. This could involve anything from painting the walls to replacing appliances or even fixing structural issues. These repairs can add up and it’s important to budget for them beforehand.

Property Tax

Another cost to consider is property taxes. Just like with any other property you own, rental properties are subject to property taxes. The amount of taxes you’ll need to pay will depend on the value of the property and the tax rates in your area. It’s important to research this beforehand so that you can accurately estimate this expense.

Insurance

Additionally, insurance is another important cost to factor in. As a landlord, it’s crucial to have insurance coverage for your rental property. This will protect you financially in case of any damages or accidents that may occur on the property. The cost of insurance will vary depending on factors such as the location of the property and its condition.

Ongoing Maintenance Fee

Ongoing maintenance fees are also an expense that you need to consider. As a landlord, it’s your responsibility to ensure that the property is well-maintained and safe for your tenants. This may involve regular maintenance tasks such as lawn care, cleaning common areas, or repairing any damages that occur over time. It’s important to budget for these ongoing expenses in order to keep your rental property in good condition.

Vacancy Rates

Furthermore, it’s crucial to take into account vacancy rates and potential rental income fluctuations. There may be times when your property is vacant and you’re not receiving any rental income. This can impact your overall cash flow and ability to cover expenses such as mortgage payments, property taxes, and maintenance costs.

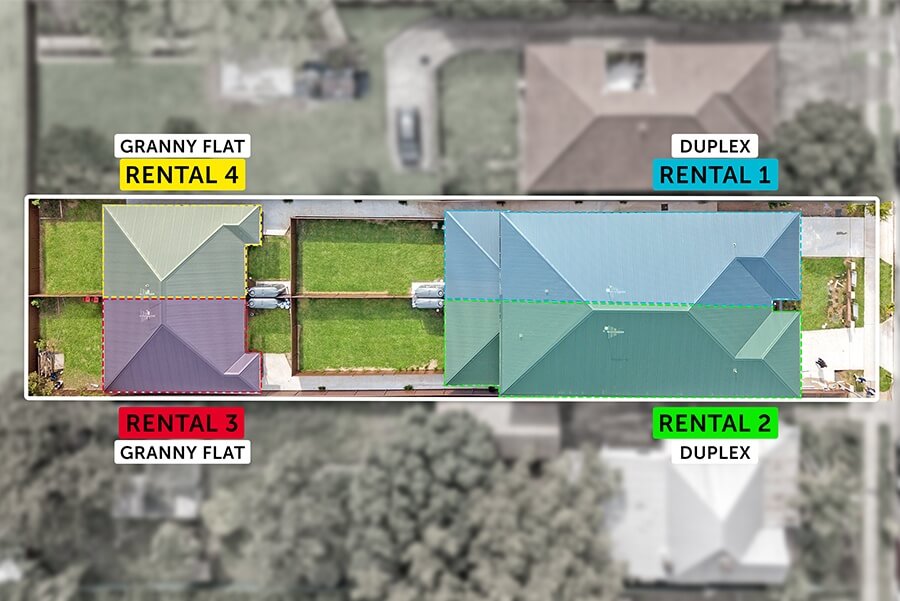

Four Rentals in One

With our combination of a spacious Duplex and two freestanding or attached Granny Flats, your tenants can have maximum privacy, full fencing, peace, quiet, functionality and affordability, while you receive the best potential profit for your block of land.

Properties One & Two: Duplex

A Duplex offers homeowners the opportunity to build a home with all the high-end fit outs and comforts, for less than the price of a single, stand-alone home. A Duplex is an investor’s best friend, offering lower construction costs and higher rental yields per property. True to its name, a Duplex is two homes in one; sharing a dividing wall and consisting of two separate entrances, offering complete privacy. Adding the two dwellings under one roof can offer greater stability to the homeowner, with separate families or individuals responsible for covering the rental costs on their property.

Where an investor could get $600 per week* for a single, stand-alone home, a Duplex could bring $450+ per week*, per dwelling; presenting a much greater profit potential and positively gearing your property*. A Duplex dwelling has many benefits for both the renter and the owner, offering security along with privacy – no ‘body corporate’ fees or noisy upstairs neighbours, and little to no garden maintenance.

Properties Three & Four: Granny Flats

Granny Flats have come a long way from converted garages or sheds and can now be built with one or two stories’, up to four rooms, a full-sized kitchen, multiple bathrooms and stunning finishes. It is easy to mistake a custom-built Granny Flat as a separate home, compact with all the features of a traditional house build.

If you own Duplex block, with two separate torrens titles, it is possible to add two Granny Flats to your existing Duplex; providing even more rental income, security and value to your highly sought-after property.

Along with the higher potential for rental income, your Granny Flat can provide:

- The ability to rent for shorter periods, charging more for long term holidaymakers or contract workers is a key consideration in rental property investment.

- Lower costs per build than a traditional home.

- Lower rates and council costs than a single dwelling.

- Fast construction time, as little as 12 weeks from start to finish.

- Safety, security and privacy for your renters.

Granny Flats are a quick and easy option to add further dwelling opportunities to your land, with no council approval needed, and the main two criteria being the appropriate land size and an attachment to your existing titles (one Granny Flat per title). Market Analysis Reports have shown that a Granny Flat can increase the average rental return on a Sydney property by up to 3.6%, translating to roughly $300 extra in your pocket every week*. With the dynamic duo of two Granny Flats accompanying your Duplex, you can have control over whether you want multiple bedrooms or a single studio, allowing you to tailor towards the type of renters you feel most confident with.

*Statements and figures are general estimates only. Speak to your local real estate agent for advice.

The Perfect Investment

With lower land costs, reduced council fees, greater potential for rental income, fast construction time and complete autonomy over the design and scope of your dwellings, a Duplex plus two Granny Flat’s are a perfect combination for any savvy, long-term investor.

We have completed projects and left many happy clients earning the maximum profit from their land, such as this property New South Homes recently completed in Wentworthville, featuring:

Inclusions Per Duplex:

- 4 Bedrooms & Guest Room with built-in wardrobes and walk-in robe to Master Bathroom andn single car garage

- Two-toned, mixed render façade

- Floor tiles to Living & Kitchen, carpet to Bedrooms

- Downlights throughout, air conditioning plus intercom and alarm security systems

- Large designer kitchen with a 40mm stone benchtop, undermount sink, polyurethane gloss cabinetry and dishwasher

- Bathroom with floor-to-ceiling wall tiles and feature wall, bathtub with two recessed niches and semi-framed shower screens

- Shadow-line cornices and vertical window blinds throughout

Inclusions Per Granny Flat:

- 60m2 Granny Flat

- 2 Bedrooms with built-in wardrobes, 1 Bathroom with Laundry

- Brick façade exterior, and decorative porch posts with sandstone capping

- Floor tiles throughout

- Downlights throughout, air conditioning plus intercom and alarm security systems

- Kitchen with a 20mm stone benchtop, polyurethane gloss cabinetry and dishwasher

- Bathroom with floor-to-ceiling wall tiles and feature wall, semi-framed shower screens

- Shadow-line cornices and vertical window blinds throughout

All four developments have their own individual gas, water and electricity meters; as well as boundary fencing and landscaping.

Get Started Today

The experienced and highly skilled team at New South Homes are excited to work with you to achieve the exact result that you had in mind when purchasing your land. If you want maximum results in profit and stability from your investment property, get in touch with New South Homes today to see how we can help, or to get the plans started for your dynamic 4-in-1 dwelling. Experience the difference for yourself when you choose to build with New South Homes – click here.

Experience

the

Difference

Ready to start your building journey? Chat to our team of experts today and get a FREE personalised quote

Find Out More

Related Posts